📖 TABLE OF CONTENTS 📖

- 1. Global Capital Trends: When AI Becomes the Billion-Dollar Bet

- 1.1 Pre-Product Startups Raising Billions - “Vision Over Traction”

- 1.2 Why Venture Capital Embraces High-Risk AI Investments

- 1.3 ETF Flows, Interest Rates & Capital Shifts Toward the U.S.

- 2. Vietnam’s Startup Investment: From Hype to High-Impact Innovation

- 2.1 Sector Shifts: Agritech, Automation, and Energy on the Rise

- 2.2 AI Hay: Vietnam’s Answer to Practical, Homegrown AI

- 3. Powering Innovation: From National Strategy to Startup Acceleration

- 3.1 Science, Technology & Innovation Law: A New Era for R&D

- 3.2 FastTrack AI: Closing the Gap Between Startups, Enterprises, and Policy

- 4. Conclusion: What Capital Flows Are Signaling Now?

In the first half of 2025, AI startups captured over 53 % of global venture capital, while Vietnam quietly prioritizes sustainable, execution-driven innovation in agritech, automation and energy - not just chasing hype.

1. Global Capital Trends: When AI Becomes the Billion-Dollar Bet

1.1 Pre-Product Startups Raising Billions – “Vision Over Traction”

In 2025, venture capital is making unprecedented bets on artificial intelligence startups, not for what they’ve built, but for what they might become. At the center of this trend is Thinking Machines Lab, the new venture launched by Mira Murati, former Chief Technology Officer and interim CEO of OpenAI. The startup reportedly closed a nearly $2 billion seed round at a pre-money valuation of $10 billion, according to Bloomberg sources familiar with the deal. What makes this raise so remarkable isn’t just its size, it’s the fact that no product, no revenue model, and no formal roadmap has been made public.

Thinking Machines founder Mira Murati (Source: Techjuice)

Led by Andreessen Horowitz, with participation from Accel, Conviction Partners, and a cohort of other elite venture firms, the round marks one of the most significant early-stage investments ever recorded in Silicon Valley. For context, many startups never raise even a fraction of that amount across their full lifecycle. In contrast, Murati’s new company secured the sum at day zero.

What, then, are investors buying into? Simply put: vision and pedigree. Murati, who joined OpenAI in 2018 and played a central role in its product and engineering strategy, has become a high-trust figure in the global AI race. Her departure from OpenAI to launch her own initiative sparked instant speculation, and investor enthusiasm followed swiftly. The extraordinary size of the round, while formally categorized as “seed,” is more accurately a strategic positioning move by top-tier firms eager to align themselves early with what they see as the next potential epoch-maker in AI.

Such an aggressive bet at the earliest stage underscores a radical recalibration of risk in AI investing. It also signals a new thesis: that leadership in AI may no longer be secured by current market traction, but by early access to visionary operators with insider experience, elite networks, and a bold take on what comes next.

This, of course, raises fundamental questions about how capital is being allocated in a world where vision increasingly trumps validation, and how emerging markets like Vietnam, where execution still reigns supreme, are responding to this bifurcation.

1.2 Why Venture Capital Embraces High-Risk AI Investments

Behind the bold capital moves into pre-product AI ventures lies a calculated yet daring strategy, rooted in two interlocking investment philosophies: the power-law return model and the strategic value of talent acquisition.

Venture capital has always been driven by the rule of extremes: a small percentage of investments deliver outsized returns. As noted by Business Insider, the power law dictates that one major winner can largely offset dozens, or even hundreds, of failures. For top-tier firms owning positions in those outliers, like an OpenAI-scale venture, the payoff can redefine entire fund performance. This is why Andreessen Horowitz, Accel, and others were prepared to commit hundreds of millions to support Thinking Machines Lab on day zero; they see mega upside in a few exceptional bets, even at the cost of many small losses.

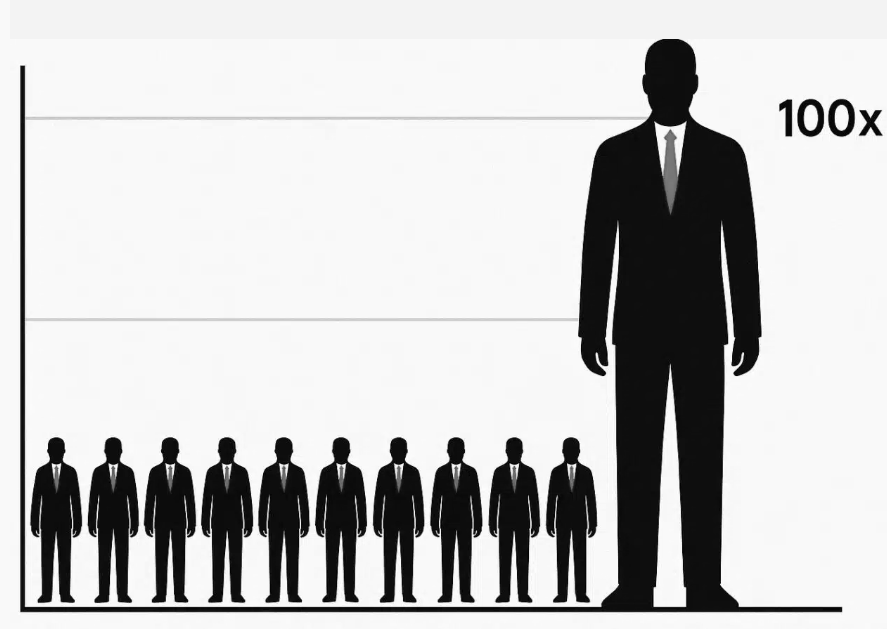

Visualizing the Power Law in Venture Capital Returns (Source: Internet)

But there is more to this strategy than chasing unicorns. Top investors are increasingly leveraging what analysts call the “Big Tech put”, a safety valve built on the acquisition potential of high-performing teams. In the last year, acquisitions like Character.AI’s $2.5 billion licensing deal with Google and Microsoft’s recruitment of Inflection AI’s core team for over $650 million highlight a new pattern. These deals cushion the risk: even if a startup doesn't reach commercial scaling, a talent-led acquisition can secure returns of 2–3x. As TechCrunch commented, “Acqui-hiring is more lucrative than it seems,” turning potential losses into modest exits.

Recent deals underscore this dual thesis. VT investors see early AI as strategic options, caps on potential upside, with fallbacks if the core venture doesn't hit product-market fit. Firms like Microsoft and Amazon view it not as reckless spending, but as a structured pathway: acquire top talent, secure tech, and avoid expensive late-stage battles.

1.3 ETF Flows, Interest Rates & Capital Shifts Toward the U.S.

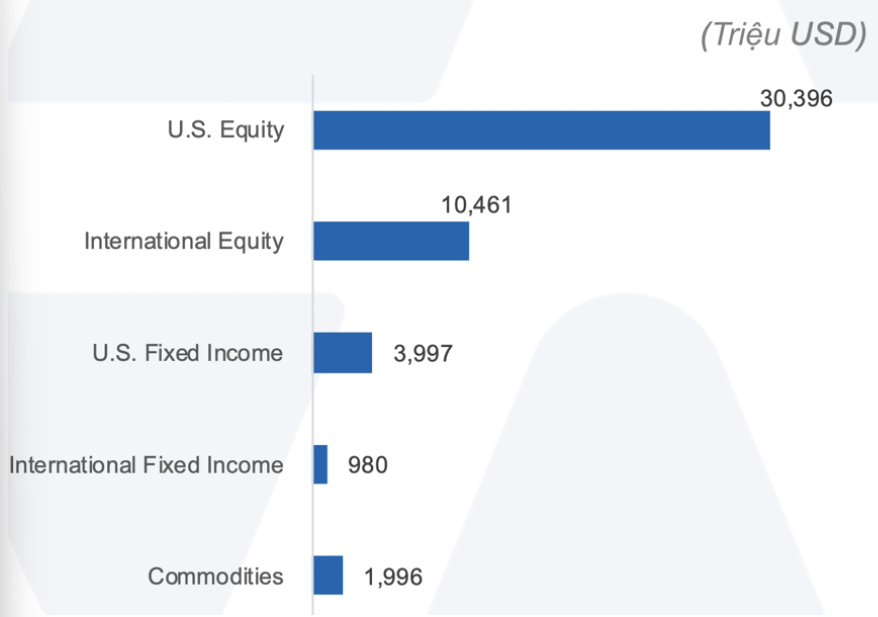

While excitement around AI continues to dominate headlines, a quieter, but equally important, shift is taking place: capital is rotating back toward U.S. markets. In May 2025, ETF flows into U.S.-listed funds rebounded strongly, with net inflows reaching $50.1 billion, the highest in the last three months, according to data from Yuanta Securities. U.S. equity ETFs led the charge, attracting $30.4 billion, while U.S. bond funds gained another $4 billion, up 86% week-on-week.

This momentum was largely driven by expectations that the U.S. Federal Reserve would keep interest rates unchanged amid slowing retail data and persistent inflation pressures. The Fed’s decision to pause has encouraged investors to shift capital toward more stable markets, with the U.S. seen as a safe harbor in uncertain macro conditions.

Meanwhile, Southeast Asia, and Vietnam in particular, saw modest capital outflows. Regional ETFs experienced net withdrawals of $7.7 million, led by funds in Indonesia and Thailand. Vietnam-focused ETFs also posted continued net redemptions: Fubon FTSE Vietnam ETF saw outflows of $1.8 million, and FUEVFVND lost another $1 million. These moves suggest a short-term retreat as global capital flows realign toward lower-risk environments.

ETF Fund Flows in the U.S. (USD Millions) (Source: Internet)

However, the shift is not permanent. According to a Bank of America survey cited by Yuanta, international (non-U.S.) equities are still viewed as the top growth asset class over the next five years, with Vietnam well-positioned thanks to its macroeconomic stability, improving market valuation, and long-term demographic potential.

2. Vietnam’s Startup Investment: From Hype to High-Impact Innovation

2.1 Sector Shifts: Agritech, Automation, and Energy on the Rise

Vietnam’s startup ecosystem is undergoing a notable transition, from chasing high-growth fintech to embracing sectors that offer deeper impact and alignment with national development. In 2025, local and regional investors are increasingly turning their focus toward agritech, industrial automation, energytech, and B2B SaaS. These sectors not only reflect Vietnam’s evolving economic priorities but also present more grounded and scalable opportunities.

One clear signal of this shift came in mid-2025, when Antler invested $2.2 million across 21 early-stage startups in Vietnam, as part of a broader $20 million strategy in Southeast Asia. This wave of early-stage funding highlights how investors are betting on local solutions, particularly those tackling long-standing infrastructure and productivity gaps across agriculture and manufacturing.

Agritech, in particular, is seeing a wave of innovation. From smart irrigation systems and crop-monitoring sensors to drones and automated farming robots, new technologies are helping farmers work faster, smarter, and more sustainably. At the core of this shift is the rise of Smart Farms, where data and automation guide everything from watering and fertilizing to harvesting. These models don’t just improve yields; they help reduce resource waste and respond better to climate challenges.

The Potential of Smart Farms in Vietnam’s Agriculture (Source: Internet)

However, adoption hurdles remain significant. High startup costs, limited rural internet, and low technical skills are slowing deployment. Many smart solutions on the market are too complex or not adapted to local needs. Despite these challenges, policy support, including high-tech agricultural zones and digital farming incentives, continues to build momentum.

This isn’t just about hype, it’s about building a resilient, data-driven agricultural industry. By merging innovation with deep local knowledge, Vietnam’s startups in agritech, automation, and energytech are not only tapping into global trends, they’re charting a uniquely Vietnamese path toward sustainable and scalable growth.

2.2 AI Hay: Vietnam’s Answer to Practical, Homegrown AI

While Silicon Valley pours billions into speculative AI bets, Vietnam is proving that real traction can win investor confidence without the hype. On July 1st, AI Hay, a Vietnamese startup blending generative AI with social interaction, announced the successful close of its $10 million Series A round. The raise was led by Argor Capital, with support from returning investors including Square Peg, Northstar Ventures, Appworks, and Phoenix Holdings.

Founded in 2022 by a team of seasoned local engineers, AI Hay aims to reimagine how Vietnamese users search, learn, and share knowledge through an AI-native, culturally attuned platform. Its core offering allows users to ask questions and receive highly accurate, cited answers, tailored for the Vietnamese language and cultural context.

In just one year since launching in June 2024, the platform has crossed 10 million app downloads and now processes over 100 million user queries each month - a scale that few Southeast Asian startups can claim. Features built for students, such as automated problem-solving and mind-map creation, have made it especially popular among younger users. AI Hay is also a founding member of the Au Lac AI Alliance and ranks among the top 5 most-used AI apps in the region, according to Sensor Tower.

A student browsing the AI Hay website on their computer (Source: Internet)

What sets AI Hay apart is its commitment to accessibility. The platform is offered entirely free, available on iOS, Android, and the web, reflecting the team’s broader mission: to equip 100 million Vietnamese with intuitive, local-language AI tools.

With this new funding, AI Hay plans to deepen its product offering across education and entertainment, roll out new AI assistant features, and strengthen its web infrastructure. According to CEO Trần Quang Đức, the investment signals “growing international belief in Vietnamese intelligence, Vietnamese-made products, and Vietnam’s national vision for widespread AI adoption.”

This success story also reflects Vietnam’s growing prominence in the region’s AI landscape. A 2024 report by NIC revealed that 27% of all generative AI startups in ASEAN are Vietnamese, attracting $780 million in funding last year alone, second only to Singapore. With AI Hay leading the charge, Vietnam is not just building AI, it’s building AI that works.

3. Powering Innovation: From National Strategy to Startup Acceleration

3.1 Science, Technology & Innovation Law: A New Era for R&D

Vietnam’s innovation journey is receiving more than just symbolic backing, it's being structurally enabled. The Law on Science, Technology and Innovation, passed on June 27, 2025, marks a foundational shift in how the country approaches R&D and commercialization. For the first time, innovation is legally recognized as a core pillar, equal to science and technology, in Vietnam’s national development framework.

National Assembly officially passed the Law on Science, Technology, and Innovation (Source: Internet)

The law restructures the regulatory ecosystem to be market-oriented, positioning businesses as the central drivers of innovation. It replaces top-down control with greater autonomy and post-audit accountability, encouraging bold experimentation through mechanisms like controlled sandboxes and risk-sharing provisions.

Importantly, it unlocks new funding flexibility. Institutions can now apply output-based budgeting for research, directly own and commercialize publicly funded innovations, and retain a minimum of 30% of resulting profits. By streamlining tech transfer, IP valuation, and tax incentives for both domestic and international talent, the law removes years-long bottlenecks to turning research into real-world impact.

The policy also emphasizes smart infrastructure and digital governance, laying the groundwork for a national data platform that connects universities, businesses, and government agencies. Provinces are empowered to build their own innovation ecosystems, including regional funds and startup centers, tailored to local development needs.

Taken together, this legislation is not just about administrative reform. It's a strategic declaration that Vietnam is ready to compete globally on brainpower, not just manufacturing.

3.2 FastTrack AI: Closing the Gap Between Startups, Enterprises, and Policy

Concurrently, the FastTrack AI Accelerator, part of the GENAI Fund initiative launched in June 2025, is actively supporting promising AI startups with capital, expert mentorship, and market entry facilitation. Backed by NVIDIA’s Inception Program, FAIA isn’t just another accelerator; it’s the first in the region to guarantee Proof-of-Concepts (PoCs) with enterprise partners from day one.

FastTrack AI Accelerator Launch Day Poster (Source: Internet)

This model responds to a growing disconnect: while 92% of AI startups in Southeast Asia focus on B2B, and Vietnam leads the region with 22% of these ventures, many struggle to reach large customers. On the flip side, enterprises are eager to adopt AI solutions but often feel startups don’t “speak their business language”. Government agencies, too, are calling for more real-world AI deployments. FastTrack AI was designed to bridge all three needs: startups need customers, enterprises need fast solutions, and governments need proven impact.

The program unfolds in four clear phases: defining enterprise use-cases, matching with qualified startups, initiating working sessions, and launching 12-week PoC pilots. Each participating startup receives not only funding but also up to $1 million in cloud and computing credits, hands-on support from NVIDIA engineers, and optional non-dilutive grants of up to $150,000 for selected AI and blockchain companies.

Beyond capital, what startups gain is market access. They’re paid to build and test their solutions inside real business environments, de-risking early deployments while validating commercial potential. On the enterprise side, companies benefit from agile, cost-effective AI teams that complement their traditional IT structures, often delivering faster results with fewer resources.

Importantly, FAIA also transfers startup culture, speed, iteration, and experimentation into corporate settings. This cultural shift is seen as essential for long-term innovation, especially in markets where digital transformation is still catching up.

Following early success with the GenAI Open Vision program in Vietnam, and a national-scale rollout in Singapore under GenAI Open Innovation, FAIA is now seen as a cornerstone of Vietnam’s strategy to not just build AI startups, but embed them within the country’s broader digital economy.

4. Conclusion: What Capital Flows Are Signaling Now?

The landscape of innovation and investment is undergoing a major reset. In the U.S., capital is flowing into pre-product AI ventures at unprecedented levels, driven by belief in vision, leadership, and long-term upside. In contrast, Vietnam’s startup ecosystem is gaining momentum through tangible impact, local relevance, and scalable execution, especially in sectors like agritech, automation, and education-focused AI.

These parallel developments reflect a broader truth: artificial intelligence is reshaping how capital is allocated, how governments support innovation, and how emerging markets compete on a global stage. Vietnam’s recent policy reforms, accelerator models like FastTrack AI, and the rise of homegrown successes such as AI Hay signal a maturing ecosystem, one that favors practical innovation and sustainable value over hype.

Rather than following global trends, Vietnam is carving out its own innovation path, bridging talent, technology, and policy to build solutions that matter, both locally and regionally. In this new era, substance, speed, and strategy are proving to be just as powerful as scale.

As Vietnam continues to shift from hype to execution in its innovation landscape, events like SURF 2025 play a vital role in sustaining momentum. Organized under the direction of the Da Nang People’s Committee and led by the city’s Department of Science and Technology, SURF 2025 returns as Central Vietnam’s flagship startup and innovation festival. This year, BambuUP joins as a co-organizing partner, bringing together startups, corporations, and investors from across the country.

Danang Innovation and Startup Festival - July 29-30

As capital becomes more focused on real impact and sustainable growth, SURF offers a space where meaningful connections are made, challenges are solved, and Vietnam’s innovation ecosystem is strengthened from the ground up. Learn more here. /

----

BambuUP boasts a strong resource network, ready to support businesses at every stage. With years of experience in the Open Innovation industry and deep connections to leading experts, we help companies uncover sustainable solutions and create long-term value.

We’ve partnered with major enterprises such as EVN, Heineken Vietnam, FASLINK, DKSH Smollan, and others to launch open innovation challenges and drive meaningful transformation. BambuUP is proud to be a trusted strategic partner, connecting global investors with high-potential Vietnamese startups, supporting innovation and accelerating growth of investment across Vietnam and beyond.

To stay updated with the latest monthly news on investment trends in Vietnam and around the world, you can: